Donate Today

We are grateful for your support!

Why You Should Donate

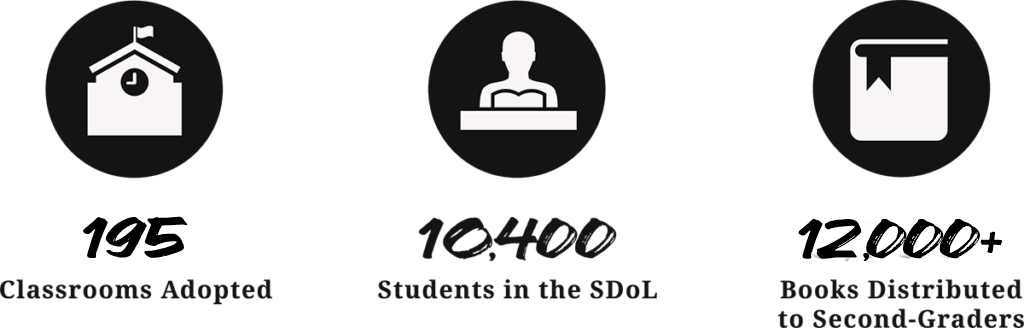

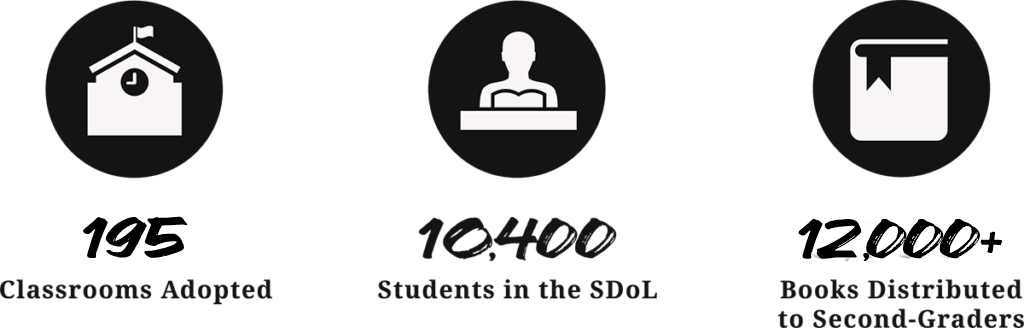

Look what your donation can do for the students in the School District of Lancaster!

We are grateful for your support!

Look what your donation can do for the students in the School District of Lancaster!